Life Insurance in and around Virginia Beach

Protection for those you care about

Now is a good time to think about Life insurance

Would you like to create a personalized life quote?

Your Life Insurance Search Is Over

When facing the loss of a loved one or your partner, grief can be overwhelming. Regular day-to-day life halts as you prepare for arrange for burial funeral services, and come to grips with a new normal devoid of the one who has died.

Protection for those you care about

Now is a good time to think about Life insurance

Life Insurance Options To Fit Your Needs

Having the right life insurance coverage can help loss be a bit less stressful for those closest to you and allow time to grieve. It can also help cover matters like utility bills, retirement contributions and childcare costs.

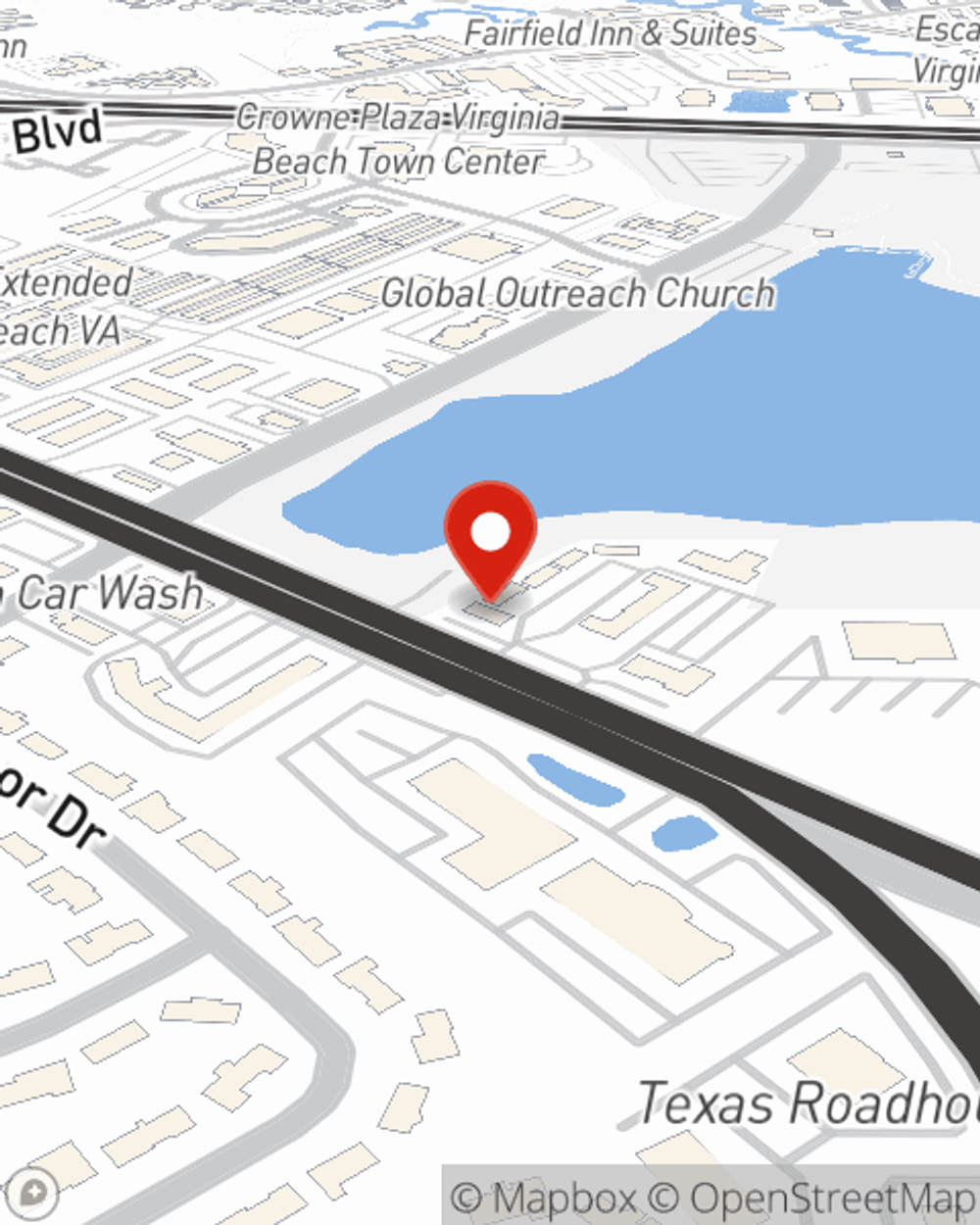

If you're looking for dependable insurance and compassionate service, you're in the right place. Call or email State Farm agent Brett Pendergast now to see which Life insurance options are right for you and your loved ones.

Have More Questions About Life Insurance?

Call Brett at (757) 499-6813 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

Brett Pendergast

State Farm® Insurance AgentSimple Insights®

Reasons to buy life insurance

Reasons to buy life insurance

Life insurance is often thought of as a way to protect loved ones by providing for final expenses and estate taxes but you can think beyond that.

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.